Frequent flyer miles can unlock incredible value—from free flights to luxury first-class seats—but only if used wisely. Unfortunately, many travelers fail to maximize their rewards, often due to a lack of knowledge, improper planning, or misunderstanding how airline loyalty programs work. While racking up miles may seem like the hard part, redeeming them efficiently can be even trickier.

In the evolving world of airline rewards, dynamic pricing, blackout dates, partner airlines, transfer ratios, and expiration rules can complicate redemption. Even seasoned travelers often fall victim to poor redemptions that cost thousands of extra miles or end up paying unnecessary fees.

This blog highlights the most factual and frequent mistakes people make when redeeming their airline miles, supported by real-world strategies and data from major airline loyalty programs. Whether you're using American AAdvantage, Delta SkyMiles, United MileagePlus, or any global carrier like Emirates Skywards or Singapore KrisFlyer, the traps are often similar.

From booking last-minute awards that inflate mileage costs to ignoring partner airline options, these mistakes can reduce the value of your hard-earned points significantly. You’ve already done the work of earning miles—now it’s time to protect that value with smarter redemption strategies.

Read on to explore six major factual redemption mistakes, each backed with practical tips and specific program insights to help you become a more informed and strategic traveler. This guide aims to arm you with everything you need to avoid waste, frustration, and missed opportunities in the complex but rewarding game of travel hacking.

One of the most frequent and impactful mistakes when redeeming miles is poor timing—either waiting until the last minute or booking too far in advance. Contrary to what many assume, both extremes can lead to inflated mileage costs and fewer flight options.

Many travelers assume that using miles last-minute is a smart strategy, especially for unexpected trips. However, last-minute award availability often comes with high redemption rates, especially with airlines that use dynamic pricing models like Delta and United. For example, a round-trip domestic ticket on Delta that might cost 25,000 miles if booked in advance could jump to over 60,000 miles when booked within two weeks of departure.

In addition to high mileage costs, late bookings can limit availability, especially for business or first-class cabins. Major airlines release limited award seats in premium cabins, and they disappear quickly.

On the flip side, booking too far in advance—more than 10 or 11 months out—can also be problematic. Many airlines don’t release full award inventory until closer to the departure date. For instance, Lufthansa often opens first-class award space only two weeks before the flight for partners like United or Aeroplan. Booking too early may mean you miss out on premium cabin seats that would become available later.

Sweet Spot Timing: The best window to book is typically 5–8 months before departure for international routes and 1–3 months for domestic trips.

Use Alerts: Use services like ExpertFlyer or AwardHacker to set alerts for award availability.

Flexible Dates: Search with flexible dates and avoid peak travel seasons like summer holidays and Christmas, which increase mileage costs.

Being strategic with your timing can help you secure the best redemption value and avoid wasting tens of thousands of points unnecessarily.

Another widespread oversight is failing to consider airline alliance partners or non-obvious redemption options. Travelers often assume they must use their miles only with the airline they earned them from—this is false and often expensive.

Major airlines are part of global alliances such as Star Alliance, Oneworld, and SkyTeam. These alliances allow you to redeem miles across multiple carriers. For example, American Airlines AAdvantage miles can be redeemed on British Airways, Qatar Airways, or Japan Airlines. United MileagePlus can be used on Lufthansa, ANA, or Turkish Airlines.

Some of the best redemption deals exist through partners. For instance:

Booking ANA business class using Virgin Atlantic miles is far cheaper than using United miles.

Using AAdvantage miles to book Qatar Qsuite flights often yields more value than booking through Qatar’s own program.

Partner redemptions can also open up routes or classes of service not offered by your home airline, including better access to long-haul international business class.

To unlock partner opportunities:

Use award search engines like Point.Me or SeatSpy that aggregate availability across alliances.

Know the transfer partners of your credit card programs (Amex, Chase, Citi), which may offer better deals through partners.

Always check partner availability before redeeming directly with your primary airline.

Be familiar with partner award charts, which may be region-based and offer better rates.

Don’t hesitate to call the airline. Some partner awards do not show up online and must be booked over the phone.

Overlooking partner airlines often leads to higher redemption costs and limited flight choices. Understanding this ecosystem is crucial for maximizing miles.

It’s easy to get excited about “free” flights or upgrades, but not every redemption is a good deal. A major mistake travelers make is redeeming miles for low-value awards, which significantly devalues their points.

Value in miles is typically calculated using the formula:

Value per mile = (Ticket Cash Price – Taxes/Fees) ÷ Miles Required

For instance:

A $200 domestic flight requiring 30,000 miles gives you only 0.67 cents per mile, which is below average.

A $5,000 business class ticket costing 100,000 miles yields 4.9 cents per mile—an excellent value.

Many programs now use dynamic pricing, where award prices reflect the cash price of the flight. This can lead to situations where using miles gives less than 1 cent per point in value.

Short-haul domestic flights during off-peak times when cash fares are low.

Basic economy tickets, which often come with restrictions.

Merchandise or gift cards, which offer abysmal value (as low as 0.5 cents per mile).

Aim for a minimum of 1.3–1.5 cents per mile when redeeming.

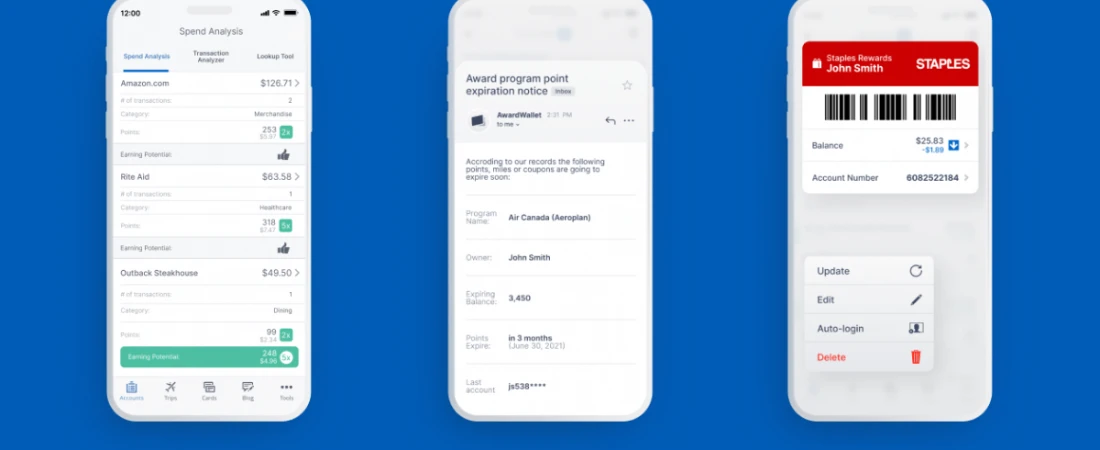

Use award calculators or point valuation guides (like The Points Guy or AwardWallet).

Avoid redemptions for cash-equivalents unless you’re in a “use them or lose them” scenario.

Miles should be saved for:

International business or first-class flights, especially on premium carriers.

High-cash-value tickets (holiday travel, last-minute flights, or premium cabins).

Partner airline redemptions with favorable charts.

Always compare the cash price and redemption value. Redeeming miles poorly is like spending money recklessly—don’t waste what you've worked hard to earn.

Many travelers focus so much on the mileage cost that they ignore cash surcharges, taxes, and cancellation penalties. These hidden costs can turn a seemingly “free” flight into an expensive ordeal.

Certain airlines, especially European and Middle Eastern carriers like British Airways, Lufthansa, and Emirates, tack on hefty fuel surcharges, even on award tickets.

Examples:

A British Airways flight from NYC to London in business class may cost 50,000 Avios + $700 in taxes and fees.

Emirates Skywards miles often come with $500+ surcharges per ticket in premium cabins.

Even though some programs have become more flexible post-COVID, not all airlines allow free changes or cancellations:

Delta SkyMiles has eliminated redeposit fees, but only for flights originating in the U.S.

Singapore Airlines still charges fees for changes and cancellations, especially on saver-level awards.

Partner bookings may have stricter policies and must often be canceled via phone.

Know the program’s award fees before booking. Look at official fee charts and cancellation policies.

Use programs like Avianca LifeMiles, Air Canada Aeroplan, or American Airlines, which don’t pass along fuel surcharges on partners.

Book award tickets with low or no change fees, especially if your plans are uncertain.

Some destinations have unusually high airport fees. For example:

London Heathrow adds significant charges.

Caribbean islands often impose departure taxes that can increase out-of-pocket costs.

Always check the total ticket cost, not just the miles required. Overlooking fees can wipe out the value of a redemption and create frustrating financial surprises.

One of the most preventable mistakes is either letting miles expire due to inactivity or hoarding miles while waiting for a “perfect” redemption that never comes.

Different loyalty programs have different mileage expiration rules:

American AAdvantage miles expire after 24 months of inactivity.

Singapore KrisFlyer miles expire 36 months after accrual, regardless of activity.

Delta SkyMiles and JetBlue TrueBlue never expire.

Many travelers forget about these expiration policies until it’s too late. Once miles expire, it’s often impossible to get them back.

While it might seem wise to save miles for a dream trip, programs frequently devalue miles, often with little or no notice. For instance:

United and Delta have moved to fully dynamic pricing, reducing value.

British Airways devalued Avios partner award charts multiple times in recent years.

Miles are not like cash; they depreciate over time. A flight that costs 60,000 miles today might cost 80,000 next year.

Make a small qualifying activity (earning or redeeming miles) to reset expiration.

Book a short flight.

Use a co-branded credit card.

Shop through airline portals.

Use tools like AwardWallet to track expiration dates.

Have a redemption plan instead of endlessly saving miles.

The goal should be value maximization, not accumulation. Hoarding miles or losing them altogether robs you of the travel experiences they were meant to provide.

Understanding how to avoid common mistakes when redeeming airline miles can significantly impact the value and satisfaction you gain from your frequent flyer rewards. From poor timing and ignoring partner airlines to falling for poor-value redemptions, high fees, and expiration risks—each misstep can lead to wasted miles and missed travel opportunities.

Many of these pitfalls are avoidable with strategic planning and a clear understanding of program rules. Booking flights within optimal windows, considering partner carriers, and always evaluating the true cost—including surcharges and taxes—can help ensure that every mile spent delivers the maximum possible benefit.

Furthermore, staying informed on loyalty program changes and being proactive about expiration policies can help you avoid losing miles altogether. Whether you're planning a luxury trip in business class or simply want to offset holiday travel costs, smart redemption decisions make all the difference.

In the world of airline rewards, knowledge truly is power. By staying educated and vigilant, you can turn your travel goals into reality without falling into common traps. Your hard-earned miles are valuable—treat them like currency, and you’ll get far more than just a seat in the sky. You’ll unlock a world of smarter, more rewarding travel.

Lina Zhou is a globe-trotting travel writer from Chengdu, China. With a passion for hidden gems and cross-cultural experiences, she shares practical tips, visa guidance, and immersive stories from every corner of the world. When not exploring, she’s sipping tea while planning her next adventure.